Charting the incredible rise of Hub24 and Netwealth

Tom Richardson

Tom Richardson

Markets reporter and commentator

Jan 21, 2020 – 4.34pm

Save

Share

Since the Future of Financial Advice (FOFA) reforms in 2012, the push to ban commissions on products recommended by financial advisers has resulted in structural shifts across the industry's dynamics.

This week, ASX-listed investments and superannuation platform provider Hub24 posted record net inflows of $2.49 billion over the six months to December 31. Its total funds-under-administration (FUA) now stands at $15.8 billion and has climbed 58 per cent on the prior corresponding period.

Its listed rival in the platforms space, Netwealth, reported it now has FUA of $25.3 billion, with growth of 31 per cent over the latest comparable quarter.

Most obviously there's nothing to stop independent financial advisers from switching between platforms at the drop of a hat.

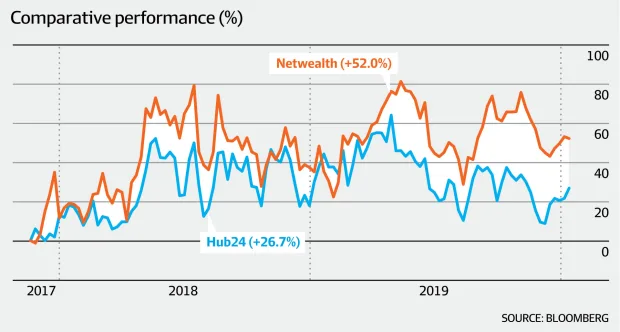

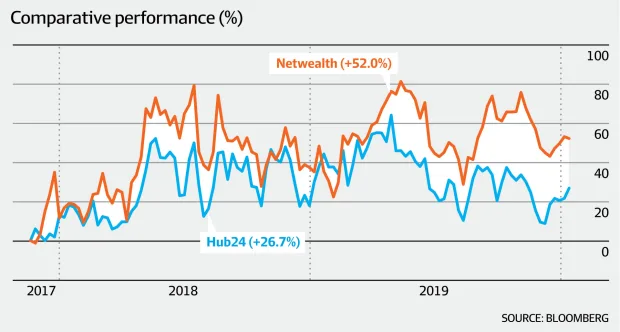

Shares in Netwealth are now up 115 per cent since its November 2017 IPO at $3.70 a share, with Hub24 shares up 1,158 per cent in five years. These are impressive numbers and for investors the headline-making changes across the financial advice industry go a long way to explaining their rises.

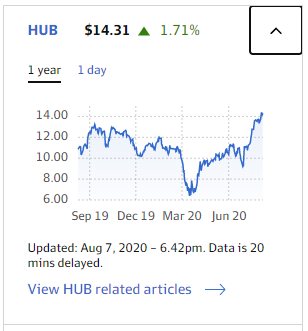

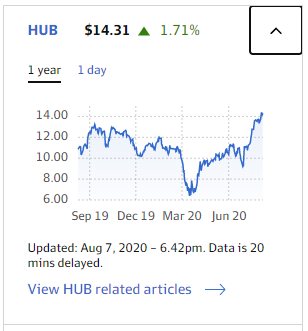

RELATED QUOTES

HUBHub24 Limited

$14.31

1.71%

1 year

1 day

Sep 19

Dec 19

Mar 20

Jun 20

6.00

8.00

10.00

12.00

14.00

Updated: Aug 7, 2020 – 6.42pm. Data is 20 mins delayed.

View HUB related articles

NWLNetwealth Group Limited

$12.60

-1.41%

Sep 19

Dec 19

Mar 20

Jun 20

5.00

7.00

9.00

11.00

13.00

Regulatory change

One consequence of FOFA is that more financial advisers have moved away from working for aligned banks or as part of dealer groups to working more independently. Partly because some of the conflicted product-pushing incentives under the aligned structure no longer exist.

This structural shift has allowed more advisers to use independent platforms as they're no longer tied to the platforms offered on approved product lists by their aligned employers or dealer groups.

However, a core problem for financial planners who work more independently is that compliance, audit, research, and other costs traditionally shared under an aligned model are higher when worn individually.

The combination of higher costs and lower commissions brought about by the regulatory reforms mean many planners are now far more amenable to the new platforms offered by challengers like Hub24 and Netwealth.

"If the newer breed of platforms can offer cheap fees and help advisers reduce their cost of fees per client then it makes sense for them to push clients onto these new platforms," says Recep III Peker of the Investment Trends industry research firm.

"The second-top driver of platform selection at the moment [behind fees] is administrative efficiency. Netwealth is most likely to be selected by advisers for this."

Recep III Peker

Recep III Peker who is research director at Investment Trends. Louie Douvis

Administrative efficiency is particularly important for advisers on lower balance accounts where regulatory and compliance costs tend to make up a higher proportion of overall fees charged.

The better cost per client reportedly offered by the newer platforms also makes them more attractive for advisers where lower balanced accounts make up a significant proportion of total accounts.

According to Mr Peker this downstream outcome for the management of lower balanced accounts accelerated from 2013 when the FOFA reforms forced advisers to adopt a fee-for-service model ahead of a product commission model.

He also says the newer platforms have offered much better managed account and separately managed account functionalities that are increasingly popular among financial advisers.

The newer platforms were also quick to embrace innovations such as mobile apps that are popular amongst clients, letting them check their investment portfolios through their smart phones.

Risks

However, some of the factors underpinning the strong net inflows the new platforms are posting could turn against them against quickly. Most obviously there's nothing to stop independent financial advisers from switching between platforms at the drop of a hat.

For new accounts an adviser can pick or choose between platforms as they wish with an adviser's choice potentially swinging on just small changes to fees or product development.

However, once a client is on one platform an adviser is unlikely to uproot them due to the administrative burden and inconvenience of re-routing the money.

According to Investment Trends research, 27 per cent of advisers switched platforms over 2019.

The research also shows the top driver of switching is high fees, suggesting the platforms don't have much pricing power even though the advisers ultimately pass fees onto the clients.

Therefore for Hub24 and Netwealth new fund flows as the drivers of growth are neither guaranteed or especially sticky. It also means they must invest a fair amount into tech and new product development going forward, as this is what their historic inflow wins have been built on.

Margins matter

Hub24 is tipping further operating profit margin growth as it scales and costs naturally grow slower than revenues. On an adjusted basis, Netwealth's operating profit margins have also been growing strongly.

The potent mix of fast-rising sales and margin growth in the fintech sector goes a long way to explaining their sky high valuations and earnings multiples.

Hub24 currently trades on 46 times Goldman Sachs' estimates for earnings per share of 25¢ in financial year 2020. The risk for investors is that the strong fund inflows could reverse quickly if competition from the incumbents or new challengers rises.

xxx

-

Juliar

- Posts: 1355

- Joined: Wed Dec 28, 2016 10:56 am

Re: xxx

Charting the incredible rise of Hub24 and Netwealth

Jan 21, 2020 – 4.34pm

Tom Richardson Markets reporter and commentator

Since the Future of Financial Advice (FOFA) reforms in 2012, the push to ban commissions on products recommended by financial advisers has resulted in structural shifts across the industry's dynamics.

This week, ASX-listed investments and superannuation platform provider Hub24 posted record net inflows of $2.49 billion over the six months to December 31. Its total funds-under-administration (FUA) now stands at $15.8 billion and has climbed 58 per cent on the prior corresponding period.

Its listed rival in the platforms space, Netwealth, reported it now has FUA of $25.3 billion, with growth of 31 per cent over the latest comparable quarter.

Most obviously there's nothing to stop independent financial advisers from switching between platforms at the drop of a hat.

Shares in Netwealth are now up 115 per cent since its November 2017 IPO at $3.70 a share, with Hub24 shares up 1,158 per cent in five years. These are impressive numbers and for investors the headline-making changes across the financial advice industry go a long way to explaining their rises.

RELATED QUOTES

Regulatory change

One consequence of FOFA is that more financial advisers have moved away from working for aligned banks or as part of dealer groups to working more independently. Partly because some of the conflicted product-pushing incentives under the aligned structure no longer exist.

This structural shift has allowed more advisers to use independent platforms as they're no longer tied to the platforms offered on approved product lists by their aligned employers or dealer groups.

However, a core problem for financial planners who work more independently is that compliance, audit, research, and other costs traditionally shared under an aligned model are higher when worn individually.

The combination of higher costs and lower commissions brought about by the regulatory reforms mean many planners are now far more amenable to the new platforms offered by challengers like Hub24 and Netwealth.

"If the newer breed of platforms can offer cheap fees and help advisers reduce their cost of fees per client then it makes sense for them to push clients onto these new platforms," says Recep III Peker of the Investment Trends industry research firm.

"The second-top driver of platform selection at the moment [behind fees] is administrative efficiency. Netwealth is most likely to be selected by advisers for this."

Recep III Peker who is research director at Investment Trends. Louie Douvis

Administrative efficiency is particularly important for advisers on lower balance accounts where regulatory and compliance costs tend to make up a higher proportion of overall fees charged.

The better cost per client reportedly offered by the newer platforms also makes them more attractive for advisers where lower balanced accounts make up a significant proportion of total accounts.

According to Mr Peker this downstream outcome for the management of lower balanced accounts accelerated from 2013 when the FOFA reforms forced advisers to adopt a fee-for-service model ahead of a product commission model.

He also says the newer platforms have offered much better managed account and separately managed account functionalities that are increasingly popular among financial advisers.

The newer platforms were also quick to embrace innovations such as mobile apps that are popular amongst clients, letting them check their investment portfolios through their smart phones.

Risks

However, some of the factors underpinning the strong net inflows the new platforms are posting could turn against them against quickly. Most obviously there's nothing to stop independent financial advisers from switching between platforms at the drop of a hat.

For new accounts an adviser can pick or choose between platforms as they wish with an adviser's choice potentially swinging on just small changes to fees or product development.

However, once a client is on one platform an adviser is unlikely to uproot them due to the administrative burden and inconvenience of re-routing the money.

According to Investment Trends research, 27 per cent of advisers switched platforms over 2019.

The research also shows the top driver of switching is high fees, suggesting the platforms don't have much pricing power even though the advisers ultimately pass fees onto the clients.

Therefore for Hub24 and Netwealth new fund flows as the drivers of growth are neither guaranteed or especially sticky. It also means they must invest a fair amount into tech and new product development going forward, as this is what their historic inflow wins have been built on.

Margins matter

Hub24 is tipping further operating profit margin growth as it scales and costs naturally grow slower than revenues. On an adjusted basis, Netwealth's operating profit margins have also been growing strongly.

The potent mix of fast-rising sales and margin growth in the fintech sector goes a long way to explaining their sky high valuations and earnings multiples.

Hub24 currently trades on 46 times Goldman Sachs' estimates for earnings per share of 25¢ in financial year 2020. The risk for investors is that the strong fund inflows could reverse quickly if competition from the incumbents or new challengers rises.

https://www.afr.com/markets/equity-mark ... 121-p53t9f

Jan 21, 2020 – 4.34pm

Tom Richardson Markets reporter and commentator

Since the Future of Financial Advice (FOFA) reforms in 2012, the push to ban commissions on products recommended by financial advisers has resulted in structural shifts across the industry's dynamics.

This week, ASX-listed investments and superannuation platform provider Hub24 posted record net inflows of $2.49 billion over the six months to December 31. Its total funds-under-administration (FUA) now stands at $15.8 billion and has climbed 58 per cent on the prior corresponding period.

Its listed rival in the platforms space, Netwealth, reported it now has FUA of $25.3 billion, with growth of 31 per cent over the latest comparable quarter.

Most obviously there's nothing to stop independent financial advisers from switching between platforms at the drop of a hat.

Shares in Netwealth are now up 115 per cent since its November 2017 IPO at $3.70 a share, with Hub24 shares up 1,158 per cent in five years. These are impressive numbers and for investors the headline-making changes across the financial advice industry go a long way to explaining their rises.

RELATED QUOTES

Regulatory change

One consequence of FOFA is that more financial advisers have moved away from working for aligned banks or as part of dealer groups to working more independently. Partly because some of the conflicted product-pushing incentives under the aligned structure no longer exist.

This structural shift has allowed more advisers to use independent platforms as they're no longer tied to the platforms offered on approved product lists by their aligned employers or dealer groups.

However, a core problem for financial planners who work more independently is that compliance, audit, research, and other costs traditionally shared under an aligned model are higher when worn individually.

The combination of higher costs and lower commissions brought about by the regulatory reforms mean many planners are now far more amenable to the new platforms offered by challengers like Hub24 and Netwealth.

"If the newer breed of platforms can offer cheap fees and help advisers reduce their cost of fees per client then it makes sense for them to push clients onto these new platforms," says Recep III Peker of the Investment Trends industry research firm.

"The second-top driver of platform selection at the moment [behind fees] is administrative efficiency. Netwealth is most likely to be selected by advisers for this."

Recep III Peker who is research director at Investment Trends. Louie Douvis

Administrative efficiency is particularly important for advisers on lower balance accounts where regulatory and compliance costs tend to make up a higher proportion of overall fees charged.

The better cost per client reportedly offered by the newer platforms also makes them more attractive for advisers where lower balanced accounts make up a significant proportion of total accounts.

According to Mr Peker this downstream outcome for the management of lower balanced accounts accelerated from 2013 when the FOFA reforms forced advisers to adopt a fee-for-service model ahead of a product commission model.

He also says the newer platforms have offered much better managed account and separately managed account functionalities that are increasingly popular among financial advisers.

The newer platforms were also quick to embrace innovations such as mobile apps that are popular amongst clients, letting them check their investment portfolios through their smart phones.

Risks

However, some of the factors underpinning the strong net inflows the new platforms are posting could turn against them against quickly. Most obviously there's nothing to stop independent financial advisers from switching between platforms at the drop of a hat.

For new accounts an adviser can pick or choose between platforms as they wish with an adviser's choice potentially swinging on just small changes to fees or product development.

However, once a client is on one platform an adviser is unlikely to uproot them due to the administrative burden and inconvenience of re-routing the money.

According to Investment Trends research, 27 per cent of advisers switched platforms over 2019.

The research also shows the top driver of switching is high fees, suggesting the platforms don't have much pricing power even though the advisers ultimately pass fees onto the clients.

Therefore for Hub24 and Netwealth new fund flows as the drivers of growth are neither guaranteed or especially sticky. It also means they must invest a fair amount into tech and new product development going forward, as this is what their historic inflow wins have been built on.

Margins matter

Hub24 is tipping further operating profit margin growth as it scales and costs naturally grow slower than revenues. On an adjusted basis, Netwealth's operating profit margins have also been growing strongly.

The potent mix of fast-rising sales and margin growth in the fintech sector goes a long way to explaining their sky high valuations and earnings multiples.

Hub24 currently trades on 46 times Goldman Sachs' estimates for earnings per share of 25¢ in financial year 2020. The risk for investors is that the strong fund inflows could reverse quickly if competition from the incumbents or new challengers rises.

https://www.afr.com/markets/equity-mark ... 121-p53t9f

Who is online

Users browsing this forum: No registered users and 2 guests